Risk Management Policy

Risk is an inherent part of GLG Crop’s business, which operates in a highly competitive market sector. GLG Corp is committed to the management of risk as an integral part of its business, focusing on strategies to minimize risk which are regarded as threats to its achievements of objectives and goals. Read more about our Risk Management Policy here

The objectives of this policy are to:

- Outline the company’s approach to risk management;

- Improve decision-making, accountability and outcomes through the effective use of risk management;

- Integrate risk management into daily operations of the company and its outsourced business partners;

- Consider risk appetite in protecting staff and business assets and strategy execution

The Audit and Risk Committee reviews and the Board approves:

- GLG’s risk management strategy and policy as prepared by management;

- GLG’s risk management framework, including key policies and procedures, including any

changes to the risk management framework or any key risk policies and procedures; and - compliance with the endorsed risk management framework through monthly reporting to

the Board.

Authority may be delegated to management where appropriate. The Audit and Risk Committee regularly reviews business risks applicable to the business and ongoing operations. Additionally, the Audit and Risk Committee considers risk profiles as part of the annualstrategy review and budget planning review. As part of the monitoring process, the Audit and Risk Committee is provided with monthly management reports, documenting as applicable

- Reports on exposures, non-compliance with key policies and general effectiveness of risk

management systems, when necessary; - Results of independent reviews of the control environment;

- Other management information.

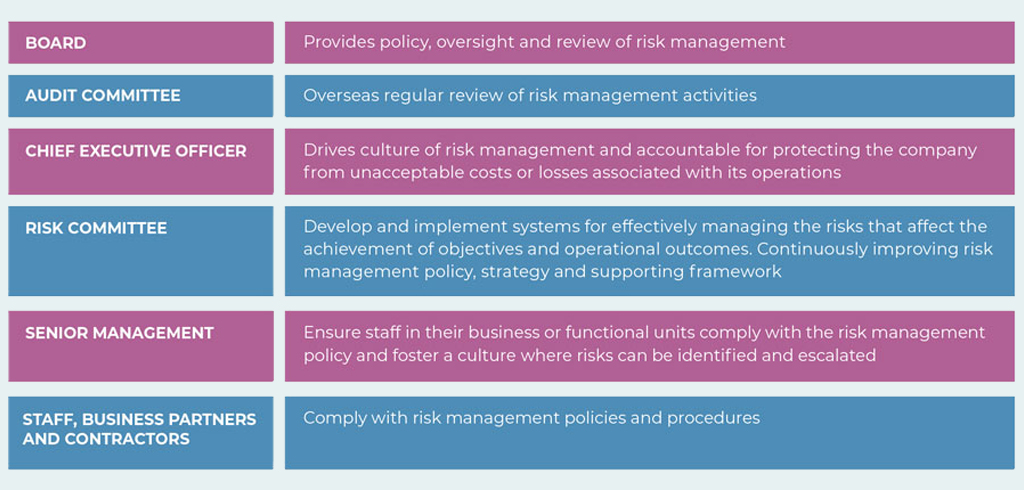

The following table summarized the roles and responsibilities of each level in discharging their duties on risk management:

- Operations

- Outsourced Partner & Manufacturing

- Legal, Regulatory & Compliance

- Resources (e.g. Human Resources, Information systems, Corporate resources, Property or Assets, etc.)

- Finance (eg liquidity, trade credit financing, foreign exchange etc.)

- Customer Business

- Competitors

- Reputations

- Investment

- External Factors (eg Hazards)

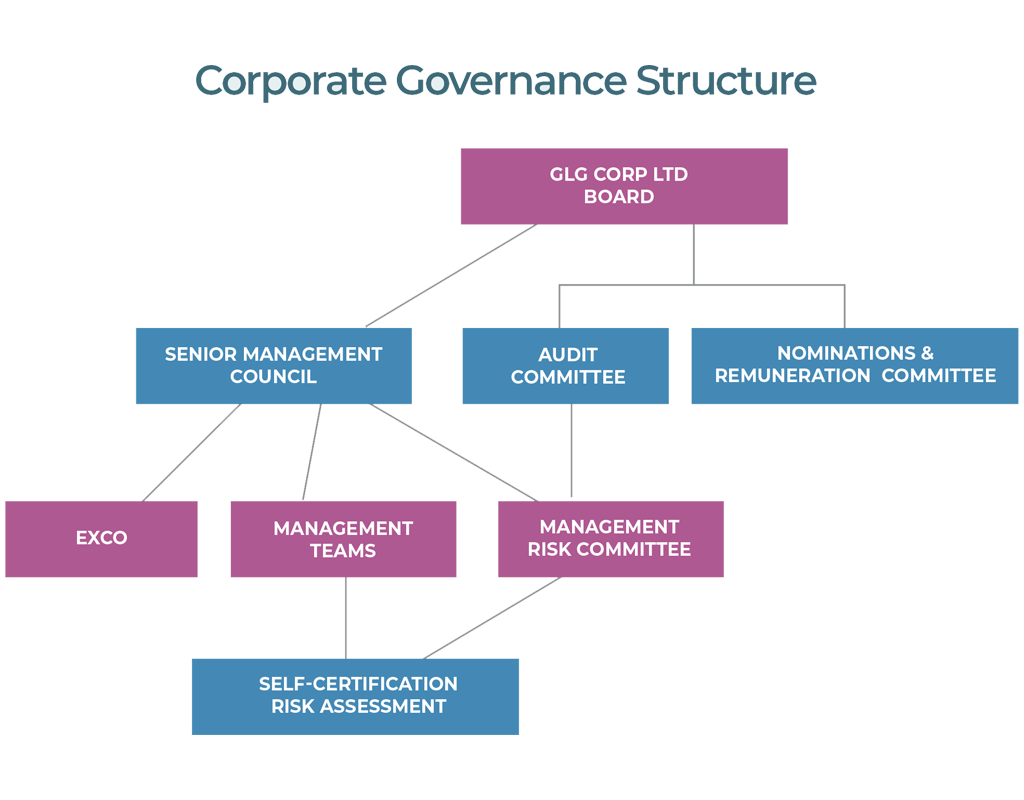

Read more about our Governance Statement here